The appetite for reform seems to be lost – Συνέντευξη Προέδρου ΣΕΒ, κ. Θεόδωρου Φέσσα στο ECONOMIA/GREEK BUSINESS FILE, April-May 2019

During the recent meeting of the IRC Committee of Business Europe in Athens, it was stated that despite the increase in Greek exports, the country’s contribution to the international trade remains stagnant (as the activity of other countries’ increases). How can that situation be rectified?

SEV was pleased to host the bi-annual meeting of International Trade and Investments Committee (IRC) of BusinessEurope in Athens in January 2019. All major European industrial associations from Europe met to discuss on the new European trade investment strategy. The meeting was an excellent opportunity for Greek companies to present their priorities directly to policy makers and counterparts from the rest of the EU.

SEV is an active participant in IRC. International trade and investment policies are key for growth in Greece. Currently, there are several free trade agreements (FTAs) under finalization at EU level (Mexico, ASEAN countries, Mercosur, Morocco, etc. The added value of FTAs to the Greek economy adds up to €4,3b since 2000, with 24% of Greek exports directed to countries with FTAs, so their importance to the Greek economy is significant.

FTAs have supported Greek exports’ significant increase in recent years. And exports drive economic recovery with a contribution of more than €33bn. For example, the recovery during 2018 was mainly driven by exports of industrial goods and services (tourism, shipping), which rose by +8.4% and +9% respectively, and contributed to GDP growth of +1.5% and +1.3%.

However, the contribution of Greek exports to global trade has remained stagnant at 0,18% for decades (0,14% excluding oil products). This stagnation happens despite the 163% export boost with FTAs (versus 96% in countries without FTAs). Despite the efforts of large industrial companies, the Greek economy seems to lack a sustainable export orientation. As a result, the trade deficit is, once again, on the increase (-€17,3b in 2018 vs -€16,1b in 2017).

Also, many SMEs still focus on the local market, while those who attempt to access international markets either lack competitiveness (currently at 50% of EU average), corporate size (only 3% of Greek SMEs are mid-sized vs 7% in EU on average), or delivery capabilities. Reshaping the economy towards tradable goods should remain a key priority for the years to come. This transformation requires investments in industrial sectors and/or added value services like ICT and Logistics.

SEV believes that investments and international trade are strongly related. The same barriers that stagnate trade also act against investments. The elimination of such barriers will improve the international investment profile of the country and at the same time will allow the local industry to manufacture tradeable goods with added value. SEV has identified a comprehensive toolkit that can expedite investments in tradeable products and services through the adoption of best practices from various EU countries to help Greece bridge the investment gap of €100b.

Key investment reforms include:

- Elimination of red tape in investment licensing through introduction of one-stop licensing agencies or “all-in-one” permits

- Simplification of justice administration through digital tools

- Labor market rules that do not compromise competitivenes

With regards to trading across borders, the following reforms will reduce the cost of accessing international markets:

- Introduction of a comprehensive tax portfolio to directly offset all taxes and duties (including VAT), including credit / debit tax payments

- Further simplification and digitalization of customs processes. The implementation of the Single Window initiative is long overdue

- Active participation of Greece in all negotiations regarding new free trade agreements. Emphasis should be given to rules of origin, geographical indications, IP protection and non-tariff barriers like standards and certification

Does SEV participate in the dialogue for the strengthening of the industrial policy in the EU and Greece? What are the main objectives of a contemporary industrial policy in Greece?

Industrial recovery remains key to growth and new jobs throughout Europe. The European Commission has proposed an ambitious strategy to increase industry’s contribution to EU GDP from 15% to 20% over the next 3 years. SEV fully supports the initiative and cooperates with BusinessEurope to promote the idea throughout Europe. It was also discussed at the IRC meeting in Athens.

In addition, SEV recently coordinated with 20 local sectoral and regional industrial associations to join the 136 EU and 395 national industrial associations in the call to EU governments to put industry at the core of the EU’s future.

SEV together with industrial associations throughout the EU call on Heads of State and Government to:

- Urge the next European Commission to name industry as a top priority of its 5-year Work Programme and appoint a dedicated Vice-President for Industry

- Require the next European Commission to swiftly present an ambitious long-term EU industrial strategy, which shall include clear indicators and governance structures

- Take stock, each year at the Spring European Council, of progress in the implementation of this EU industrial strategy and provide political guidance to foster European competitiveness

In Greece, SEV asks the government to agree upon a comprehensive industrial strategy to reverse de-industrialization. All local stakeholders should agree on policies that aim to increase the contribution of industry to GDP to 12% in 3 years (9,6% today) and to 15% in the medium term. By converging with the EU average, Greece’s industry could gradually create 500.000 new jobs, setup industrial ecosystems with local SMEs and promote regional growth in areas with few employment alternatives.

In Greece, the need for a cohesive industrial policy is even more urgent. What are the main proposals of SEV in this respect?

The growth potential of Greek companies is hindered by the business environment. Investment and administrative barriers have affected industrial competitiveness in the last 20 years. Such barriers include quality of institutions, product markets, labor market, trading across borders, innovation capability, environmental licensing, tax evasion, over-taxation, cost of finance, delays in justice administration, etc.

Despite such a problematic business environment, manufacturing remains key to the growth potential of the country. It comprises 90% of exports (90%), with more than 220 international trade destinations (increased by 17% since 2017). Also, industrial investments exceed €26bn during the crisis and still support stable and well-paid jobs.

To increase industry’s GDP contribution to 12% in 3 years and 15% in the medium term, the following key policy recommendations remain a priority, in addition to the elimination of administrative barriers:

Taxation

- 30% reduction of corporate tax burden (CIT and Social Security contributions)

- Tax incentives (namely super and/or accelerated depreciations) to encourage investments on Industry 4.0 technologies and machinery

- Significant reduction on personal income tax for private sector employees

Energy market

- Alignment with the EU target model. Offer competitive pricing to the local industry

- Deliver projects regarding network connections

Funding

- Resolve insolvency issues and address NPE cases

- Reform state-aid allocation to direct co-funding towards grow-up / scale-up projects

Skills

- Up-skilling / re-skilling that contributes to Industry 4.0 competetiveness

Given that the post-surveillance framework limits the room on manoeuver on the taxation issue, which structural reforms should Greece urgently implement in order to improve its competitive position internationally? Which reforms should become a priority?

Greece has implemented key reforms to ratify fiscal imbalances and set the fundamentals to return to economic normality. Provisional data indicates a growth around 1.9% in 2018 vs. projections of +2.1%. This is in line with estimates for low growth in the coming years, as uncertainty related to the upcoming elections holds back investment plans, while risks associated with external demand, mainly due to the slowdown in world trade, are rising.

The recent upgrade of Greece’s rating by Moody’s by two notches (at B1 from B3) is also a positive development. Additionally, the fact that Greece managed to raise €2.5 bn in bond markets with the issuance of a 10-year bond (with 3.9% interest rate), underlines the belief of the financial markets, as represented by long term institutional investors, that the country is on the right track. This assessment is broadly compatible with the content of the recent European Commission reports on Greece, one in the context of the European Semester and the other as part of the enhanced surveillance.

It is also fair to say that the country has made some mild progress with respect to investment promotion reforms. Recent legislation encourages productive investments and job creation by introducing tax incentives for all business sizes and sectors, simplified subsidy allocation for SMEs and significant reduction of the customs burden. Though over-taxation is not properly tackled, the adopted measures include some key SEV recommendations and proposals. These proposals were extensively discussed during SEV’s main public events the last two years, such as the Investment Conference, the Industrial Forum as well as at the SMEs’ Conference. They include:

- Updated legislation for strategic investments

- 130% super-deduction of R&D expenditure. Tax exemptions for R&D capital. Patent box (tax exemption)

- 200% super-depreciation for energy efficiency investments

- 150% super-deduction of labor costs and Employers’ contribution subsidy (for employees under 25 years old)

- Tax incentives for shared service centers (super-deductions)

- Simplification of state-aid allocation with accelerated depreciations

- Licensing simplification: Tax warehouses – customs warehouses – tax free zones

- Licensing simplification: land uses and construction permits on certain areas

- Licensing simplification: industrial parks and logistics parks

- Simplification of corporate transformations

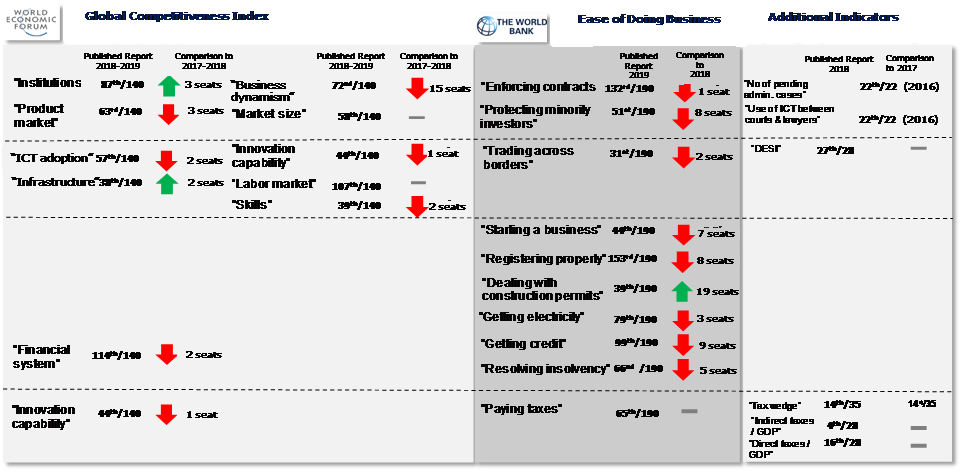

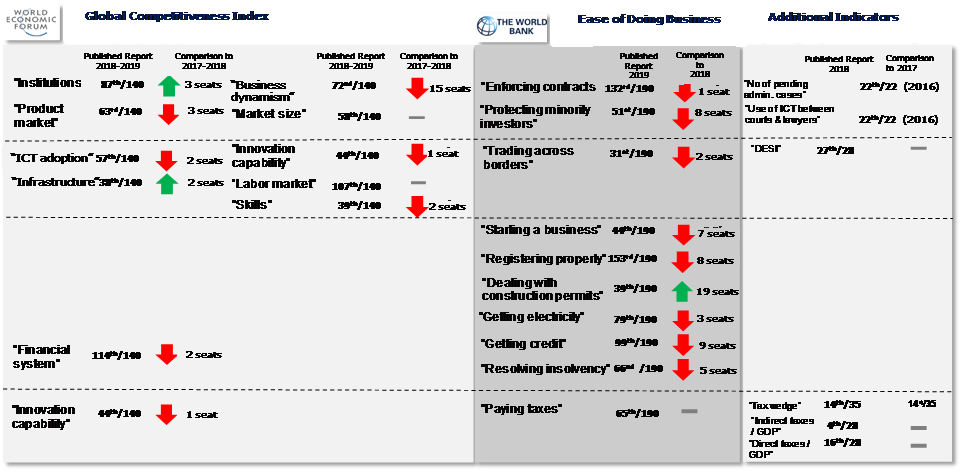

However, appetite for reform seems to be lost. As a result, Greece is retreating in many international indicators regarding investment competitiveness. In the WEF competitiveness index, Greece fell 4 places in 2018 and currently ranks 57th out of 140 countries (27th in EU-28). In the World Bank – Doing Business Index, Greece lost5 places in 2018 and currently ranks 72nd out of 190 countries, and, again, 27th in EU-28. Further analysis on investment-related indicators, support the argument that reforms should return to the top of the political agenda. Institutions, Infrastructure and Dealing with Construction Permits seem to be three exceptions.

Certain areas could still improve significantly: a) the implementation of the “better regulation agenda”, b) the implementation of an action plan to combat corruption through electronic transactions and invoicing, c) the qualitative improvement of the education system and the connection of the education system and research centers with the market, d) the full assessment of the fact that Greek companies have been excluded from the Single Market for Financial Services since the onset of the crisis. This caused significant competitive disadvantages for Greek businesses which operate within the Single Market and e) the fact that the manufacturing base of the country, that the first MOU envisioned would spearhead the export-led recovery, remains relatively weak.

In addition, to safeguard fiscal stability, overtaxation must be dealt with, together with planning and delivering useful infrastructure projects.

How can the Center of Excellence of SEV contribute to the improvement of the corporate landscape in Greece?

For SEV, connecting knowledge and entrepreneurship is a key prerequisite for growth. Knowledge is a vital ingredient of entrepreneurship which touches upon it’s every aspect and determines its ability to survive and grow. Today in Greece however, there is a relative disconnect between entrepreneurship and education which has led to a significant skills-gap. Recent research by IOBE among 800 SEV member-companies found that skills shortages exist in key productive sectors. In AgroFood and Logistics, 50% of companies are affected, while in Energy, Construction Materials and Health, it’s 45%. CEDEFOP’s Skills Panorama* places Greece as an EU laggard, while the OECD worryingly notes the stagnation of the intergenerational cognitive level. In the same vein, higher education’s impact is also low among OECD** countries. At the same time, skills’ level does not seem to change according to employment status which means that higher skilled people are not employed more.

All this means that the acquired skills do not cover businesses’ needs, and the reason is the chasm between education and entrepreneurship. It’s clear that we need to change our strategy with respect to the creation, dissemination and utilization of knowledge. The challenge lies in the constant adaptation to the requirements of the new economy, for all levels of education and skills, and for the consistent improvement of all human resources through upskilling and re-skilling.

SEV’s educational initiatives include the Junior Achievement Greece for children, IVEPE for vocational training and lifelong learning, as well as the cooperation with Alba Graduate Business School, The American College of Greece. All efforts aim to fulfill the economy’s need for innovation, new skills, adaptation to technological change, etc. Together with soft skills, critical thinking, creativity, and cooperation, they are prerequisites for growth.

Just as digital and technological progress is changing the way we work, so too, we must change the ways we are educated. Investment in human capital is not just a sound investment. It is a necessary one. That is the idea at the centre of the cooperation between SEV and ALBA.

Our Learning Alliance aims to capitalize on comparative advantages and to strengthen modern administrative and business knowledge and practices. Supporting workers’ development, exchanging views and experiences, learning how to seize opportunities stemming from technology (e.g. digital marketing) are all necessary in order to create a new generation of leaders with vision and abilities.

The SEV Centre of Excellence in Creative Leadership will be a meeting point for academic and business leadership through annual fora, roundtable discussions, as well as applied research and Field Consulting Projects for members of SEV. SEV and ALBA cooperation also includes scholarships (50%) for executives’ postgraduate courses at ALBA, presentations by business executives in ALBA’s academic courses in order to strengthen their interplay, and specialized seminars (16-50 hours) for all levels of management (senior, middle and junior)

Could you elaborate on how the ongoing collaboration and dialogue between SEV and Business Europe contribute to the strengthening of the industrial sector in Greece?

SEV is a very active participant in BusinessEurope activities and in constant contact with EU officials to present the views, concerns and proposals of Greek industry. Supported by the permanent delegation in Brussels, SEV networks it members with decision-makers to lobby for policies that strengthen Greek Industry. The current agenda that SEV is pushing for in Brussels includes industrial growth, energy networks and competitive pricing, climate change and sustainable development, expedited access to international markets, eliminating barriers to investments, attracting FDI, promoting better regulation in EU directives, simplifying competition rules, strengthening the digital economy, implementing Industry 4.0 initiatives, etc.

** OECD, (2016), “Greece-Country Note-Skills Matter: Further Results from the Survey of Adults Skills”